GST Collection in March: A Boon for the Indian Economy

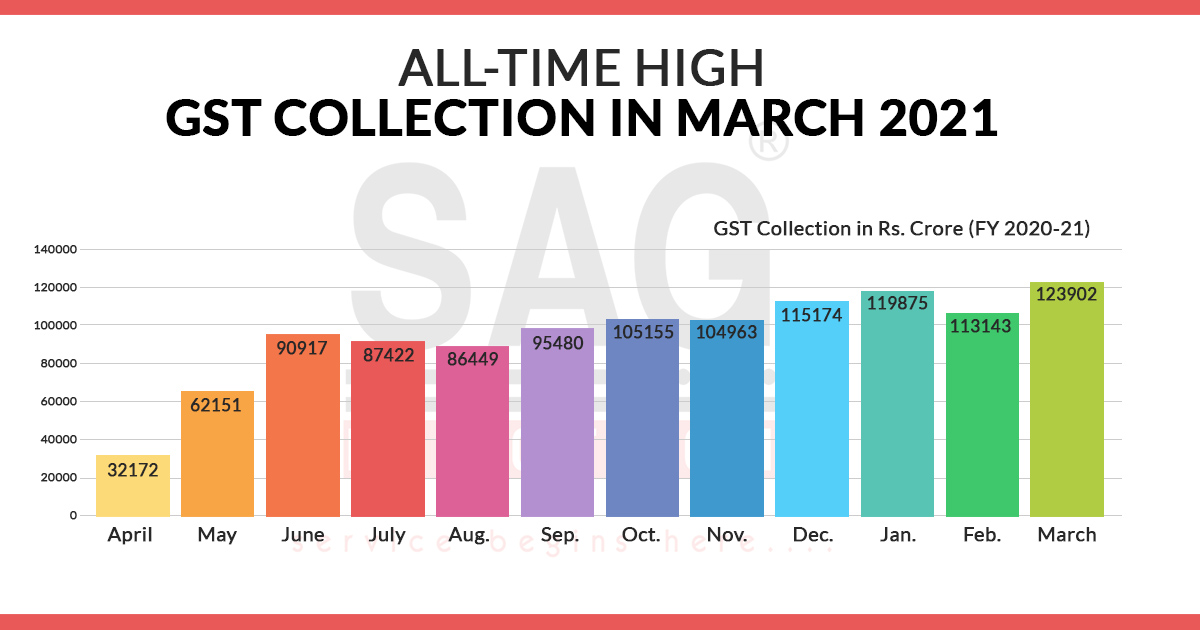

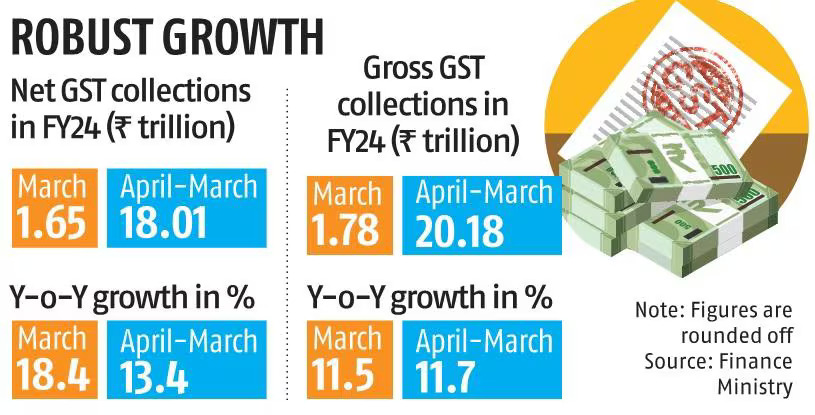

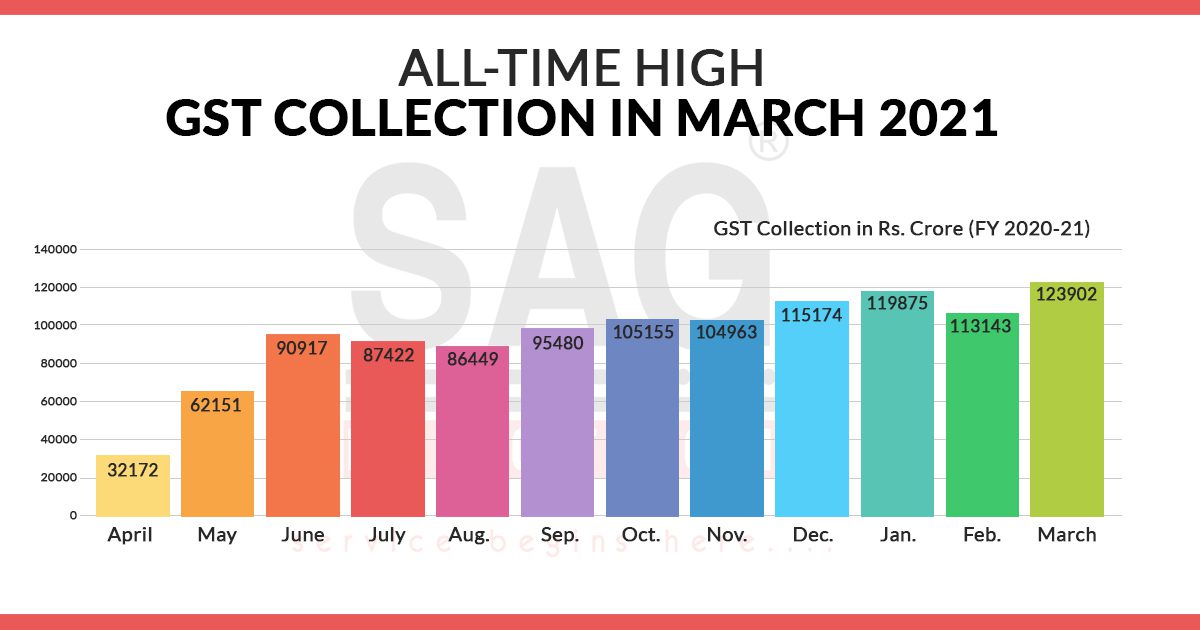

GST Latest News: India’s Goods and Services Tax (GST) collection in March 2024 witnessed a significant surge, reaching a staggering Rs 1.78 lakh crore. This phenomenal achievement marks the second-highest GST collection ever recorded since the tax’s implementation in July 2017.

What is GST? Introduced to streamline the indirect tax system in India, GST is a single, unified tax levied on the supply of goods and services. It replaced a complex web of state and central taxes, simplifying tax compliance for businesses.

GST Collection in March: A Sign of Economic Growth

This robust March collection signifies positive developments in the Indian economy. The 11.5% year-on-year growth in GST collection indicates a rise in domestic economic activity. Businesses are likely experiencing increased sales, translating into higher tax contributions.

How is GST Good for Businesses?

GST has simplified compliance for businesses of all sizes. By eliminating cascading taxes like VAT, GST reduces the overall tax burden for businesses. Additionally, the ease of filing GST returns online saves valuable time and resources.

Breaking Down the Numbers

The strong GST collection in March can be attributed to several factors. There’s been a notable rise in domestic transactions, with a 17.6% year-on-year growth. This suggests a pick-up in consumer spending and business activity within the country.

GST Latest News: A Breakdown by Segment

Looking deeper, the Central Goods and Services Tax (CGST) stood at Rs 34,532 crore, while the State Goods and Services Tax (SGST) reached Rs 43,746 crore. The Integrated Goods and Services Tax (IGST) on domestic transactions amounted to Rs 47,625 crore, and import of goods contributed Rs 40,322 crore to IGST collection.

Positive Outlook for FY24

The robust March collection has pushed the total GST collection for the entire financial year (FY24) to a record-breaking Rs 20.14 lakh crore. This surpasses the revised budget estimate and reflects an impressive 11.7% growth compared to the previous year.

GST: A Catalyst for Transparency and Efficiency

The success of GST lies in its ability to bring transparency and efficiency to the tax system. Businesses no longer need to deal with multiple tax authorities, reducing compliance costs and administrative burdens.

GST Latest News: Impact on Government Finances

The strong GST collections provide the government with much-needed revenue for crucial infrastructure projects and social welfare programs. This financial stability fosters economic development and improves the overall quality of life for citizens.

The Road Ahead for GST

While the recent surge in GST collection is encouraging, there’s always room for improvement. Streamlining the GST rate structure and simplifying the compliance process can further incentivize businesses and boost economic activity.

GST in India: A Force for Positive Change

The GST has undoubtedly been a transformative reform for the Indian economy. It has simplified tax administration, facilitated interstate trade, and promoted a more transparent business environment. The robust GST collection in March is a testament to the positive impact of GST on the Indian economy.

Looking Forward: Building on the Momentum

By continuously streamlining processes and addressing industry concerns, the government can further strengthen the GST regime. This will ensure that GST continues to act as a catalyst for economic growth and development in India.

Conclusion

The phenomenal GST collection in March 2024 is a positive indicator of the Indian economy’s resilience. As the government works towards further simplifying GST compliance, we can expect even stronger GST collections in the future, propelling India’s economic growth to new heights.

How Businesses are Thriving Under GST in India

GST Latest News: The recent surge in GST collection in March 2024 highlights the positive impact of GST on businesses [1]. But what are some specific examples of how businesses are benefiting from this transformative tax reform?

Simplified Compliance: Replacing a maze of state and central taxes, GST offers a single, unified tax structure. This reduces compliance costs for businesses, especially small and medium enterprises (SMEs). No longer do companies need to navigate complex tax laws and file returns with multiple authorities.

Example 1: Seamless Movement of Goods

Earlier, transporting goods across states involved paying various taxes at each border checkpoint, causing delays and disruptions. Under GST, the concept of “one nation, one tax” eliminates these inter-state barriers. This streamlines logistics, reduces transportation costs, and allows businesses to deliver products faster.

Example 2: Reduced Paperwork Burden

GST allows for online filing of tax returns, eliminating the need for extensive paperwork. Businesses save valuable time and resources that can be channeled into core operations and growth strategies.

Credit Utilization for Lower Tax Liability

Businesses can claim input tax credit (ITC) on taxes paid on purchases. This credit can be offset against the GST liability on their sales, effectively reducing their overall tax burden.

Example 3: Increased Working Capital

Faster claim settlement of ITC translates into improved cash flow for businesses. This frees up working capital that can be used for expansion, innovation, or inventory management.

Boosting Competitiveness in the Market

By streamlining compliance and reducing tax costs, GST levels the playing field for businesses. Smaller players can now compete more effectively with larger companies, fostering a more vibrant and competitive market environment.

How is GST Good for Large Businesses?

Large businesses also benefit from GST. The standardized tax structure simplifies inter-branch transactions and facilitates consolidation of operations across various states. Additionally, GST promotes transparency and reduces the risk of tax evasion, creating a fairer business environment.

GST in India: The Road Ahead

While GST has demonstrably benefited businesses, there’s always room for improvement. Ongoing efforts to simplify the tax rate structure and further streamline compliance processes will unlock even greater benefits for businesses of all sizes.

Challenges and Solutions for the GST Regime in India

GST Latest News: The record-breaking GST collection in March 2024 underscores the success of this tax reform [1]. However, the GST regime in India is not without its challenges. Let’s explore some potential hurdles and propose solutions for a smoother GST experience.

Challenge 1: Complexities in Rate Structure

The current GST structure has multiple tax rates (5%, 12%, 18%, and 28%), which can be complex for businesses to navigate. This complexity can lead to errors in classification and filing, attracting penalties.

Solution 1: Streamlining Tax Rates

Simplifying the GST rate structure by reducing the number of tax slabs can improve ease of compliance and reduce confusion for businesses.

Challenge 2: High Compliance Burden for SMEs

While GST has simplified compliance compared to the previous tax regime, smaller businesses might still find the current system daunting. Filing returns and adhering to GST regulations can be a significant burden, especially for those with limited resources.

Solution 2: Simplifying Compliance for SMEs

The government can introduce simplified GST return forms and filing processes specifically designed for SMEs. Additionally, educational initiatives and workshops can help them navigate the system more effectively.

Challenge 3: Frequent Changes in GST Rules

Regular updates and modifications to GST rules can create confusion and disrupt business operations. Businesses need time to adapt to changes and update their systems accordingly.

Solution 3: Transparent Communication of Changes

The government can ensure clear and timely communication of any upcoming changes to GST rules. This allows businesses to prepare for the modifications and minimizes disruption.

Challenge 4: Evasion and Fake Invoices

The presence of fake invoices and tax evasion attempts continue to pose challenges for the GST regime. These illegal practices distort tax collection and create unfair competition for compliant businesses.

Solution 4: Strengthening Anti-Evasion Measures

The government can implement stricter measures to detect and penalize tax evasion. Leveraging technology for data analysis and risk assessment can be crucial in combating these practices.

GST in India: A Collaborative Approach

Addressing these challenges requires a collaborative effort from the government, tax authorities, and businesses. Open communication, ongoing simplification efforts, and robust anti-evasion measures are key to ensuring the continued success of the GST regime.

Government Initiatives to Promote GST Awareness and Compliance

GST Latest News: The phenomenal GST collection in March 2024 signifies the growing acceptance and understanding of GST by businesses [1]. However, promoting continuous awareness and compliance remains crucial for the long-term success of the tax reform.

What is GST?

GST is a single, unified tax levied on the supply of goods and services in India. It replaced a complex web of state and central taxes, aiming to simplify tax administration and boost economic activity.

Government Initiatives for GST Awareness

The Indian government has undertaken several initiatives to educate taxpayers about GST and encourage compliance:

- Online GST Portal: The government provides a comprehensive online GST portal containing informative resources, tutorials, and FAQs on various GST aspects.

- Capacity Building Programs: Regular workshops and seminars are conducted across the country to educate businesses of all sizes about GST procedures and compliance requirements.

- Helpdesks and Toll-Free Numbers: Dedicated helplines and toll-free numbers are established to address taxpayer queries and provide support related to GST filing and registration.

- Outreach Programs: The government collaborates with industry associations and chambers of commerce to conduct outreach programs and raise awareness about GST among specific sectors.

- GST Suvidha Kendra (GSK): These physical facilitation centers offer in-person assistance to taxpayers, particularly those in smaller towns and rural areas.

GST in India: Promoting Transparency and Collaboration

These initiatives emphasize the government’s commitment to transparency and collaboration in the implementation of GST. By actively engaging taxpayers and providing necessary support, the government aims to ensure a smooth transition to the new tax regime.

How is GST Good for Businesses?

GST offers numerous benefits for businesses, including:

- Reduced Tax Burden: The input tax credit mechanism allows businesses to claim credit for taxes paid on purchases, effectively reducing their overall tax liability.

- Improved Cash Flow: Faster settlement of ITC claims translates into better cash flow for businesses, which can be used for growth and expansion.

- Level Playing Field: GST creates a fairer business environment by simplifying taxes and reducing the scope for tax evasion.

GST Latest News: Encouraging Two-Way Communication

The government also encourages two-way communication with taxpayers. Feedback mechanisms are implemented to gather suggestions and address concerns related to GST implementation. This ensures that the system continuously evolves to meet the needs of businesses.

The Role of Technology in GST

Technology plays a vital role in promoting GST awareness and compliance. The online GST portal facilitates registration, filing of returns, and payment of taxes. Additionally, mobile apps and e-invoicing systems further simplify tax administration.

GST in India: A Continuous Journey

The government’s initiatives for GST awareness and compliance are ongoing. As the GST regime matures, further efforts might be required to address emerging challenges and adapt to evolving business needs.

Unlocking Growth: How GST is Empowering Businesses and Transforming the Indian Economy

The phenomenal surge in GST collection in March 2024 serves as a testament to the transformative power of the Goods and Services Tax (GST) in India [1]. This blog series has explored various aspects of GST, highlighting its benefits for businesses, potential challenges, and government initiatives promoting GST awareness and compliance.

Empowering Businesses for Growth Through GST

GST in India has demonstrably simplified GST compliance for businesses of all sizes. By eliminating cascading taxes and offering a unified tax structure, GST reduces the administrative burden and associated costs. Businesses can now focus their resources on core operations, innovation, and expansion. The input tax credit mechanism further benefits businesses by lowering their overall GST liability and improving cash flow. This translates into increased investment opportunities and a more vibrant business environment.

Addressing Challenges for a Smoother GST Experience

However, the GST regime is not without its challenges. The current multi-tiered GST rate structure can be complex for businesses to navigate, and frequent changes in regulations can create confusion for businesses trying to understand the latest GST news. Additionally, ensuring GST compliance remains crucial, particularly for smaller businesses (SMEs) with limited resources.

The path forward lies in ongoing collaboration between the government, tax authorities, and businesses. Streamlining the GST rate structure, providing clear communication regarding rule changes, and offering simplified compliance processes for SMEs are some key steps. Additionally, robust anti-evasion measures are essential to ensure a fair and transparent tax system that benefits businesses complying with GST latest news.

Government Initiatives: Building a Supportive Ecosystem for GST

The Indian government is actively engaged in promoting GST awareness and compliance. The comprehensive online GST portal serves as a valuable resource for businesses, providing them with informative content, tutorials, and FAQs on various GST aspects. Capacity building programs, helplines, outreach programs, and physical facilitation centers like GST Suvidha Kendra (GSK) further empower businesses by offering guidance and support on how is GST good for them.

These initiatives emphasize transparency and collaboration. By actively engaging taxpayers and addressing their concerns about GST in India, the government fosters a supportive ecosystem for GST implementation. The two-way communication channels established also allow for continuous improvement and adaptation of the system based on evolving business needs, ensuring businesses are up-to-date on the latest GST news.

Technology as a Catalyst for Efficiency in GST

Technology plays a vital role in simplifying GST and promoting compliance. The online GST portal streamlines registration, filing of returns, and tax payments, making GST compliance much easier for businesses. Mobile apps and e-invoicing systems further enhance efficiency and convenience for businesses navigating the GST latest news. As technology continues to advance, we can expect even more innovative solutions to emerge, further simplifying tax administration for businesses of all sizes.

Looking Forward: A Collaborative Journey for Economic Prosperity with GST

The journey of GST in India is ongoing. As the system matures, continued efforts will be required to address emerging challenges, optimize processes, and adapt to the evolving business landscape. By working together, the government, tax authorities, industry associations, and businesses can ensure the continued success of GST.

A Thriving Economy: The Power of GST

With a simplified tax system, reduced compliance burdens, and improved cash flow for businesses, GST has the potential to be a game-changer for the Indian economy. As businesses thrive under GST in India and economic activity expands, we can expect even stronger GST collections in the future. This, in turn, will provide the government with much-needed revenue for crucial infrastructure projects and social welfare programs, fostering a more prosperous and equitable India.

Unlocking Growth: A Collaborative Effort

The success of GST hinges on a collaborative effort from all stakeholders. Businesses are encouraged to actively engage with the government and industry associations to voice their concerns and suggestions regarding GST compliance and the GST rate structure. By staying informed about the latest GST news, businesses can adapt their operations and ensure smooth implementation.

Industry Associations: Championing GST Awareness

Industry associations play a crucial role in promoting GST awareness among their members. By organizing workshops, webinars, and disseminating informative resources, these associations can empower businesses, particularly SMEs, to navigate the intricacies of GST. Additionally, they can act as a bridge between businesses and the government, facilitating communication and fostering a collaborative environment for continuous improvement of the GST regime.

The Road Ahead: A Vision for a Thriving GST Ecosystem

As India progresses on its GST journey, a continued focus on simplification, transparency, and technology adoption is paramount. Streamlining the GST rate structure, minimizing changes to GST latest news, and leveraging technology for data analysis and risk assessment can further strengthen the system. By fostering a culture of open communication and collaboration, all stakeholders can work together to unlock the full potential of GST and propel the Indian economy towards a brighter future.

In conclusion, GST has undeniably transformed the Indian tax landscape. By fostering a collaborative environment, simplifying compliance processes, and promoting continuous improvement, all stakeholders can work together to ensure that GST continues to act as a catalyst for economic growth and development in India.

Resources:

- https://www.business-standard.com/economy/news/gst-collections-hit-rs-1-78-trillion-in-march-the-second-highest-ever-124040100732_1.html

- https://www.sakshi.com/telugu-news/business/gst-collections-will-be-high-march-2010133

- https://timesofindia.indiatimes.com/business/india-business/gst-march-tally-second-highest-at-rs-1-8l-cr-rs-20l-cr-for-year/articleshow/108957414.cms

- https://www.thehindu.com/business/Economy/gross-gst-revenues-hit-their-second-highest-level-of-178484-crore-in-march/article68015809.ece

- https://www.businesstoday.in/latest/economy/story/march-gst-collection-second-highest-ever-at-rs-178-lakh-crore-a-115-growth-yoy-423734-2024-04-01

For more economy and business news: https://waddupindia.in/category/business/

5 thoughts on “GST Collection in March Goes Up: A Boon for the Growing Indian Economy – Latest News on GST 2024”

Your article helped me a lot, is there any more related content? Thanks!

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article. https://www.binance.com/join?ref=P9L9FQKY

Your article helped me a lot, is there any more related content? Thanks! https://www.binance.info/en-IN/register?ref=UM6SMJM3

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://www.binance.com/en/register?ref=JHQQKNKN

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.